There have been some wildly successful free NFT drops on Internet Computer. If you are a part of the ecosystem at all, you are no doubt familiar with ICPunks, which boast a floor price of over 7 ICP despite being free to claim on the public mint date.

Another very successful free drop is the Motoko Day Drop collection. To celebrate the second anniversary of the programming language, DFINITY released 10,000 Motoko NFTs. Many were airdropped to active DSCVR users, while others became a free giveaway at NFT NYC. Over the last two weeks, the floor price is climbing rapidly. What can NFT collectors learn from watching the meteoric rise of the Motoko NFTs?

It All Starts at the Floor

One of the first things a person will look at to determine the strength of a project is the floor price. This makes sense because if you hold the most common NFT in a collection, the floor price determines its value. No one will pay more unless there is something special about the NFT (rare or unique traits, an attractive appearance, etc.). For the Motoko NFTs, the floor price started at less than one. This is common with a free giveaway. Anything you get for it is a realized gain, so there will always be those who flip a free giveaway for some quick cryptocurrency.

However, about two weeks ago, things started to change for the Motoko NFTs. Collectors began buying up ones at the floor price, which quickly became 3 ICP, 4 ICP, and now 6 ICP! This reveals one possible investment strategy: Buying multiples at the floor price.

The advantage of this strategy is that the only thing required to make a profit is for the floor price to continue to rise. Plus, you can enter with minimal investment and the lowest possible risk.

The Hunt for Appealing Traits Begins

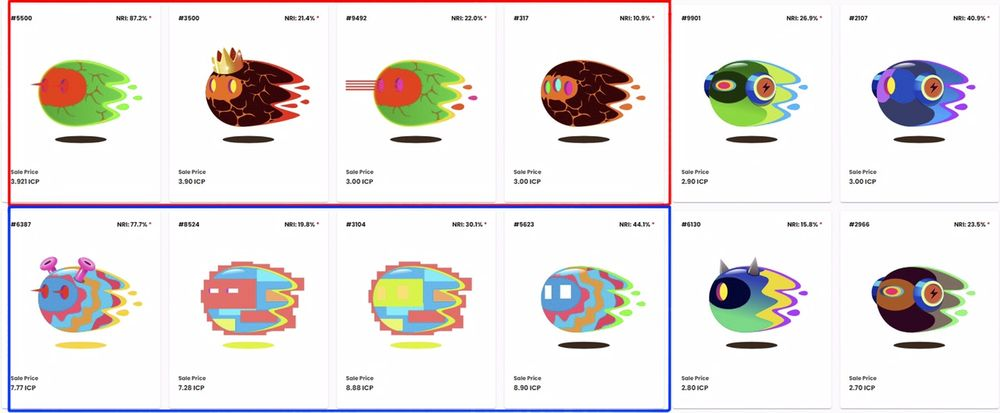

As the floor price rises, collectors start to target specific traits that they feel are rare or appealing. As a result, we begin to see similar-looking Mokoto NFTs sell back-to-back. Take a look at the following image to get an idea of how collectors target specific traits.

In the red box, you see four similar Motoko NFTs that sold near at would have been the floor price at the time. While two are green in coloration and two are brown, the collector was clearly looking for NFTs with cracks in the body art.

In the blue box, we see the same thing occurs. While we again see two different body types – the blocks and the wavy lines – we again see a common thread. Someone was looking for color schemes that could become rare or valuable. As a result, we see that these were all purchased for close to the same price, albeit higher than the floor price. Thus, a second NFT collector strategy emerges: Collecting multiple NFTs with similar traits that the collector believes are or will become sought after.

A Shift from Floor Price Sweeps to Rare Snipes

If you look at recent sales in the collection, you will notice fewer purchases at the floor price. Collectors are now trying to sweep any remaining rares in the 10-20 ICP range. Additionally, some extremely rare or sought-after traits are selling in the 20-70 ICP range. This is the next collector strategy: Acquiring sought-after rares to hold. You will be unlikely to see any of these on the market again for months or perhaps even years. After all, some collectors don't intend to sell. They make up the final NFT collector strategy: Hold till death.

- Disclaimer: The views and opinions expressed on this website are solely those of the original author and other contributors. These views and opinions do not necessarily represent those of the Dfinity Community staff and/or any/all contributors to this site.

Comments are for members only. Join the conversation by subscribing 👇.