Welcome to another DEX review

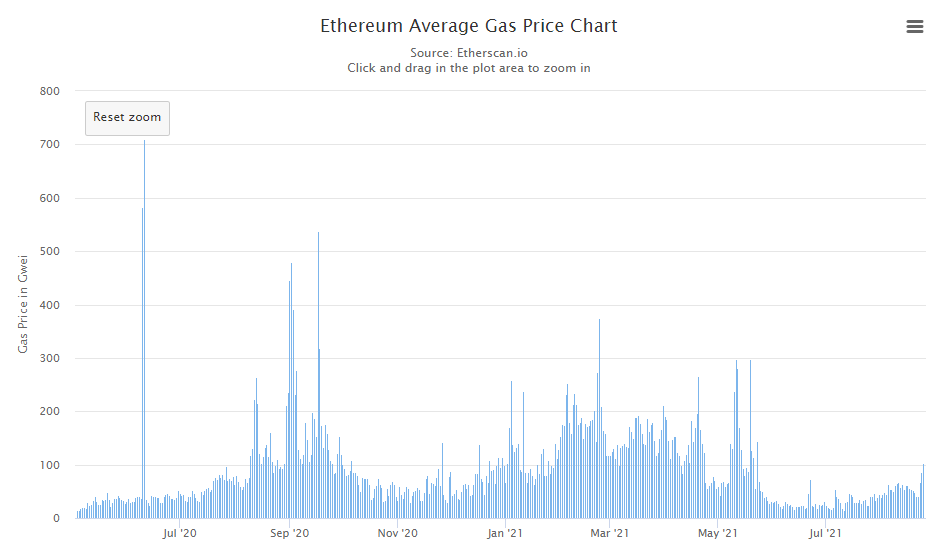

When we talk about DeFi, we seldom forget to mention Ethereum. But Ethereum has its own disadvantages. Ethereum transactions take few minutes, and sometimes the gas fees are through the roof. But gas fees and transaction delays aren't the only things that torment ETH and limit the DeFi revolution. Scalability and the fact that 60% percent of ETH nodes run on the corporate cloud is something to worry about.

So what about Binance Smart Chain? Well, Binance is a centralized cryptocurrency exchange, So BSC isn’t truly decentralized either.

Uniswap received backlash from the community for not being decentralized when it removed some tokens from its exchange listing. The front end of almost all Ethereum dapps are hosted on corporate clouds. But the clouds alone aren't responsible for the troubles faced by DeFi. Web Speed and Scalability are vital too.

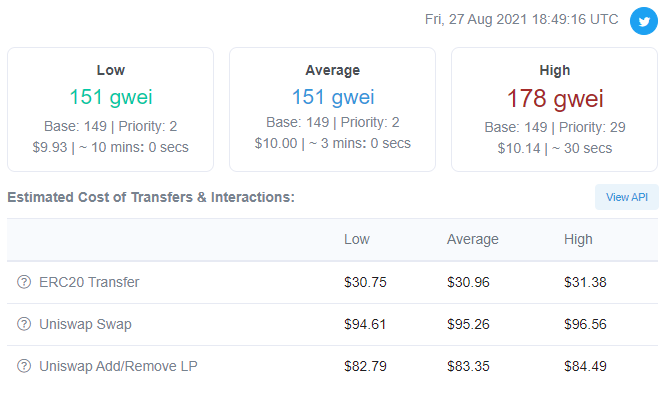

You can see it takes $80+ to Add/Remove LP on Uniswap. This is extremely inefficient.

Most of the DEX transactions happen in either BSC or Polygon right now. Polygon is a layer two solution for Ethereum's scalability problem. With reverse gas and Open Governance, Internet Computer brings a whole new meaning to DeFi and Blockchain.

With the creation of the Internet Computer, blockchain smart contracts evolved into something powerful that makes existing technology obsolete. The canisters are the next generation of smart contracts that scale and operate at web speed. As they can decouple from their environment, replicate and interact with other canisters, one just has to imagine and connect the canisters to create!

DeFi on the IC is more user-friendly to ordinary users, truly open to everyone, No insane gas fees, fast speed. Ethereum DeFi is more like the game of whales now, most ordinary users cannot even cover the gas cost. On the IC, that won't be a problem.

What storm is the Internet Computer's DEXs about to bring/unleash?

- Web Speed transactions - no more waiting around 10 Minutes for a swap.

- Security and Anonymity that comes with Internet Computer Protocol.

- Amazing User Experience.

- Powerful Smart Contract Canisters will change the way we see DeFi by blending it with many things - Tokenize Everything!

- No need to pay gas fees as Internet Computer has a reverse gas model.

- No one will dare to censor you on the Internet Computer.

- The Nodes do not run on any corporate clouds.

- Massive interoperability opportunity with canister smart contracts.

- Everything runs on-chain - Front-end, backend, and governance.

Did you know that an Internet Identity can’t be tracked across dapps?

DFinance: Decentralized Finance on the Internet Computer

I am glad to welcome DFinance, the newest DeFi addition to the Internet Computer Ecosystem.

DFinance platform is composed of a collection of DeFi protocols, enabling users to issue their own tokens, trade their tokens, and earn rewards by providing liquidity. More financial primitives are coming in the future.

DFinance runs entirely on the Internet Computer protocol, enabling it to provide a wide variety of decentralized financial Services with maximum efficiency. Remember the Reverse Gas Model !?

- DFinance has received a $25,000 Grant from DFINITY Foundation and has conducted Round 1 Airdrop on the testnet.

Announcing DFinance testnet, we are launching the first AMM decentralized exchange on the Internet Computer! 🚀🚀🚀

— DFinance (@DFinance_AI) August 25, 2021

Join now to get whitelisted for our Airdrop Round I event!

Testnet App: https://t.co/nlr7d6XjCB

Docs: https://t.co/E3fTaUBUpbhttps://t.co/WihQhCpovX

Here are some of the features highlighted by DFinance

- Automated Market Maker Decentralized Exchanges

AMM allows traders to trade quickly and directly with the liquidity pool and removes the counterparty. The interested clients can trade/swap directly with the Liquidity pool and remove the need to interact.

- Lightning Swap - Swapping tokens with lightning speed.

- Secure Atomic Swap - Within Canisters, because Canisters in Internet Computer have 2-second delay on update calls.

- Liquidity providers earn a 0.3% transaction fee.

- API for developers to build their application based on DSwap - Liquidity Farming protocols.

DFinance Swap(DSwap) will provide APIs for developers to build their applications based on DSwap, such as liquidity farming apps.

Testnet review

Some of the features released on the testnet are:

- DFinance browser wallet for the IC.

- One-Click Token issuance.

- DFinance swap.

- Yield farming, the first liquidity farming pool on the IC.

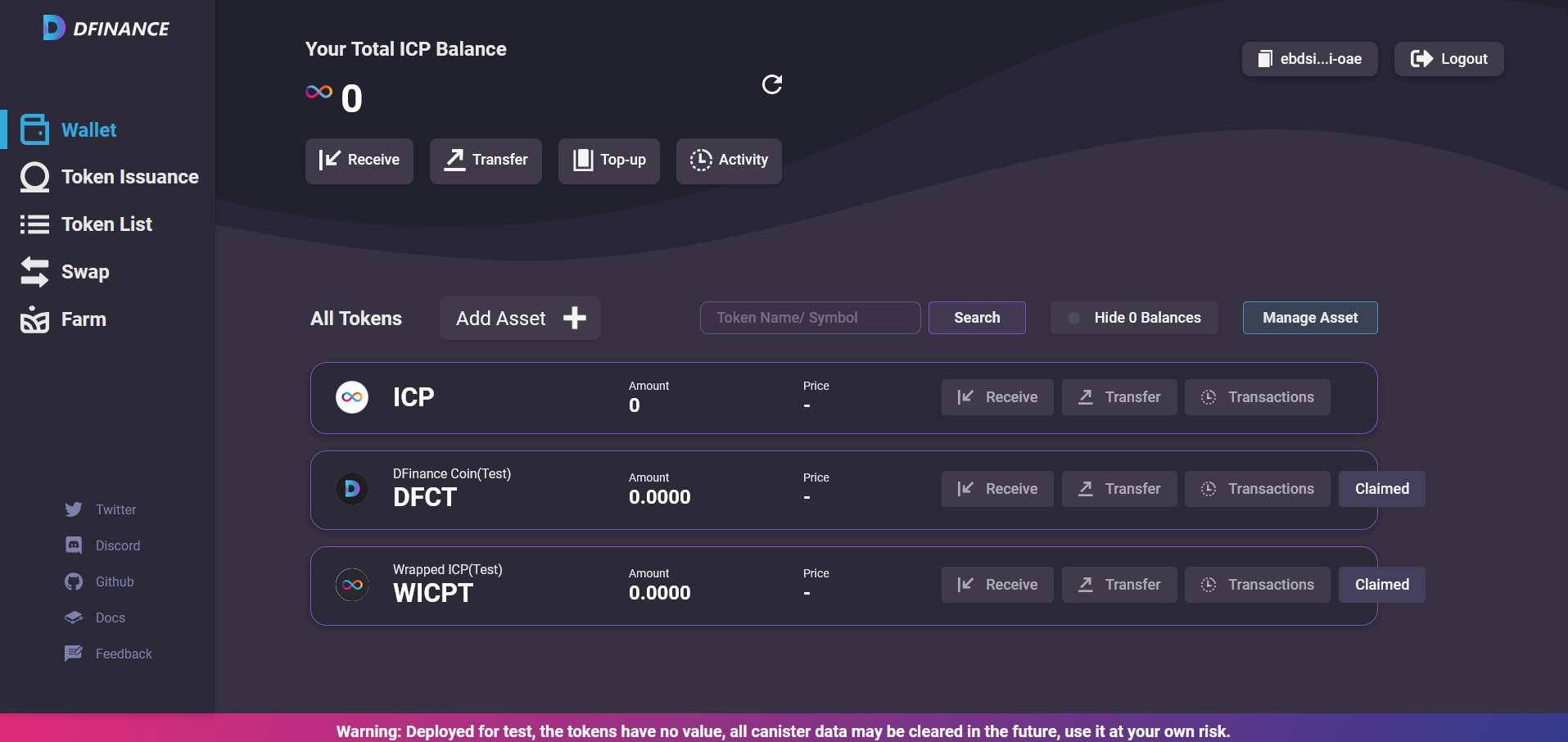

DFinance browser wallet for the IC

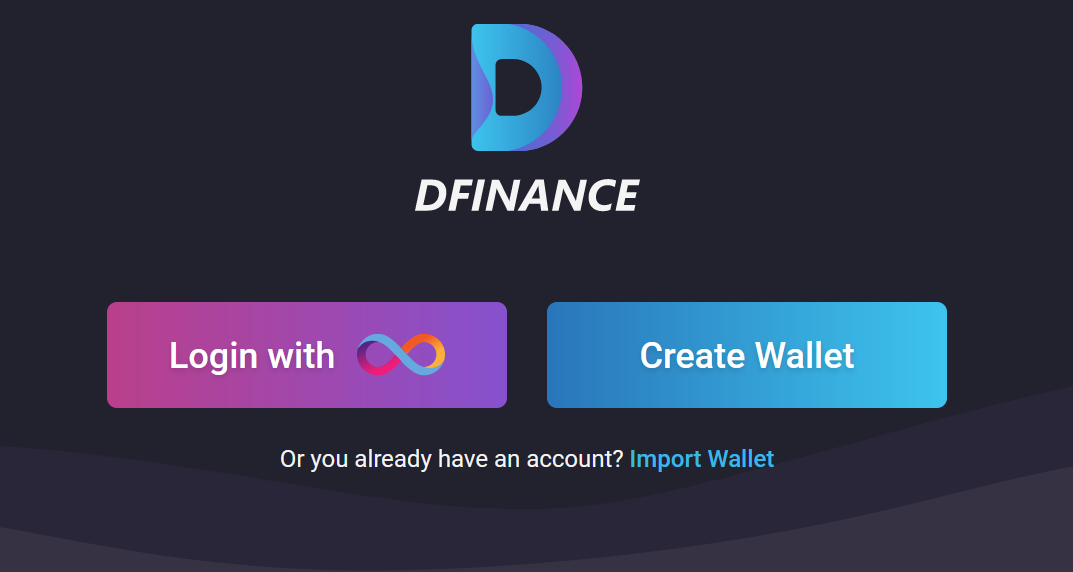

DFinance browser wallet can be accessed through the site app.dfinance.ai. Users can authenticate or log in using Internet Identity or by creating a new wallet.

Creating a new wallet will provide you with a seed phrase, and you can log in using a password once you create a wallet. However, Internet Identity enables two-click login just like in any other dapp using Internet Identity.

After you log in, you can look at your dashboard.

Users can claim test tokens and test the product. Test tokens can be used to swap, one-click token issuance, and liquidity farming.

WICP is similar to Wrapped ETH (WETH) and 1 WICP equals 1 ICP. Since the canisters in Internet Computer cannot hold ICP at the moment, WICP is introduced by DFinance. Wrapping ICP inside the canister simplifies the code and unifies the interfaces.

However, on DFINITY's r0admap, we can see that the foundation is working on allowing canisters to store ICP, which is limited as of now for security reasons.

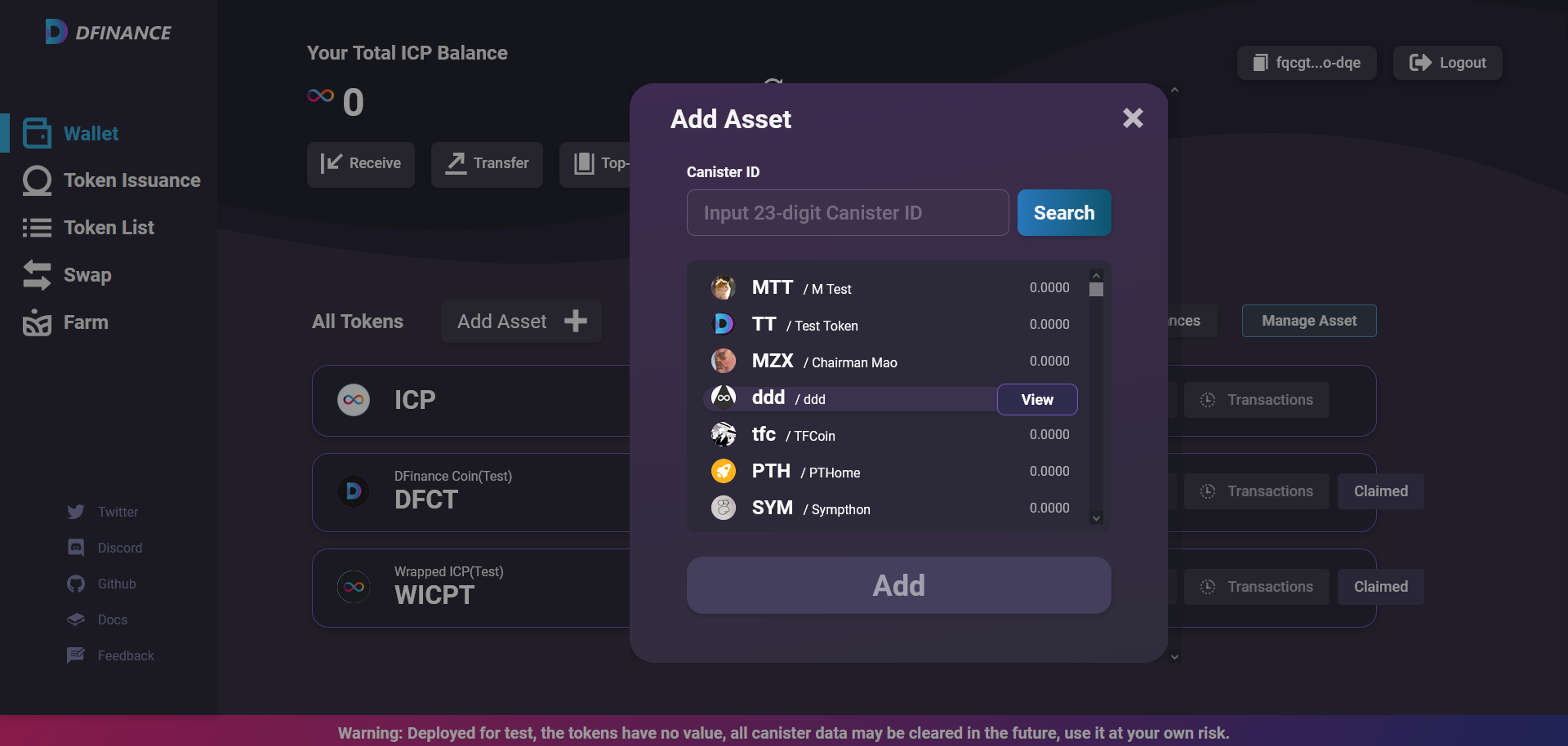

Users can add their favorite tokens to their wallet list with just a few clicks or directly from the canister ID of the token they want to add.

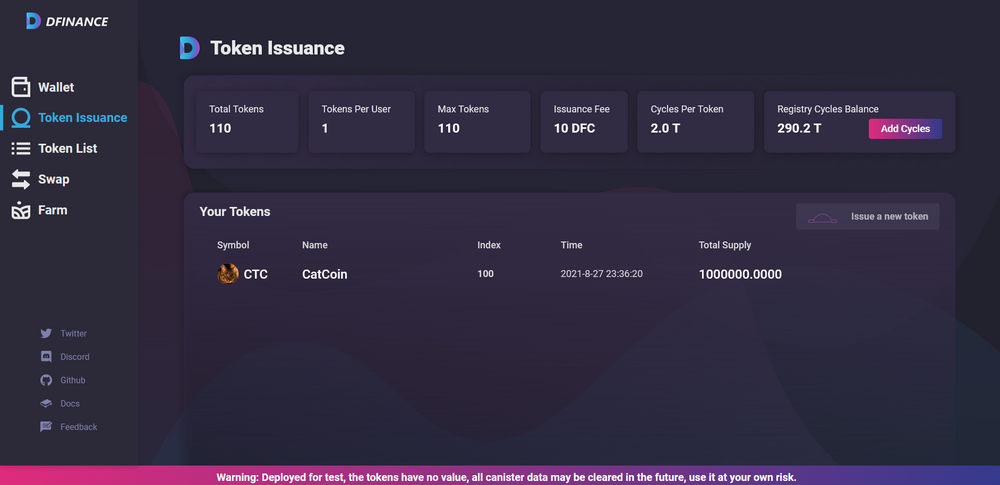

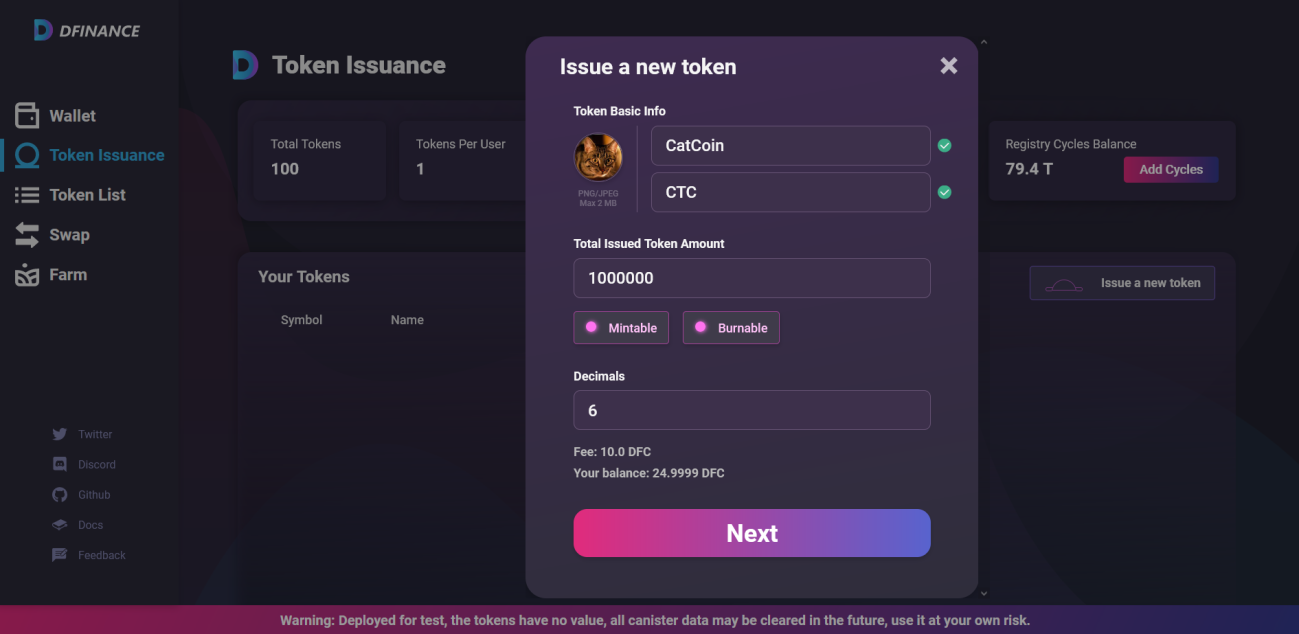

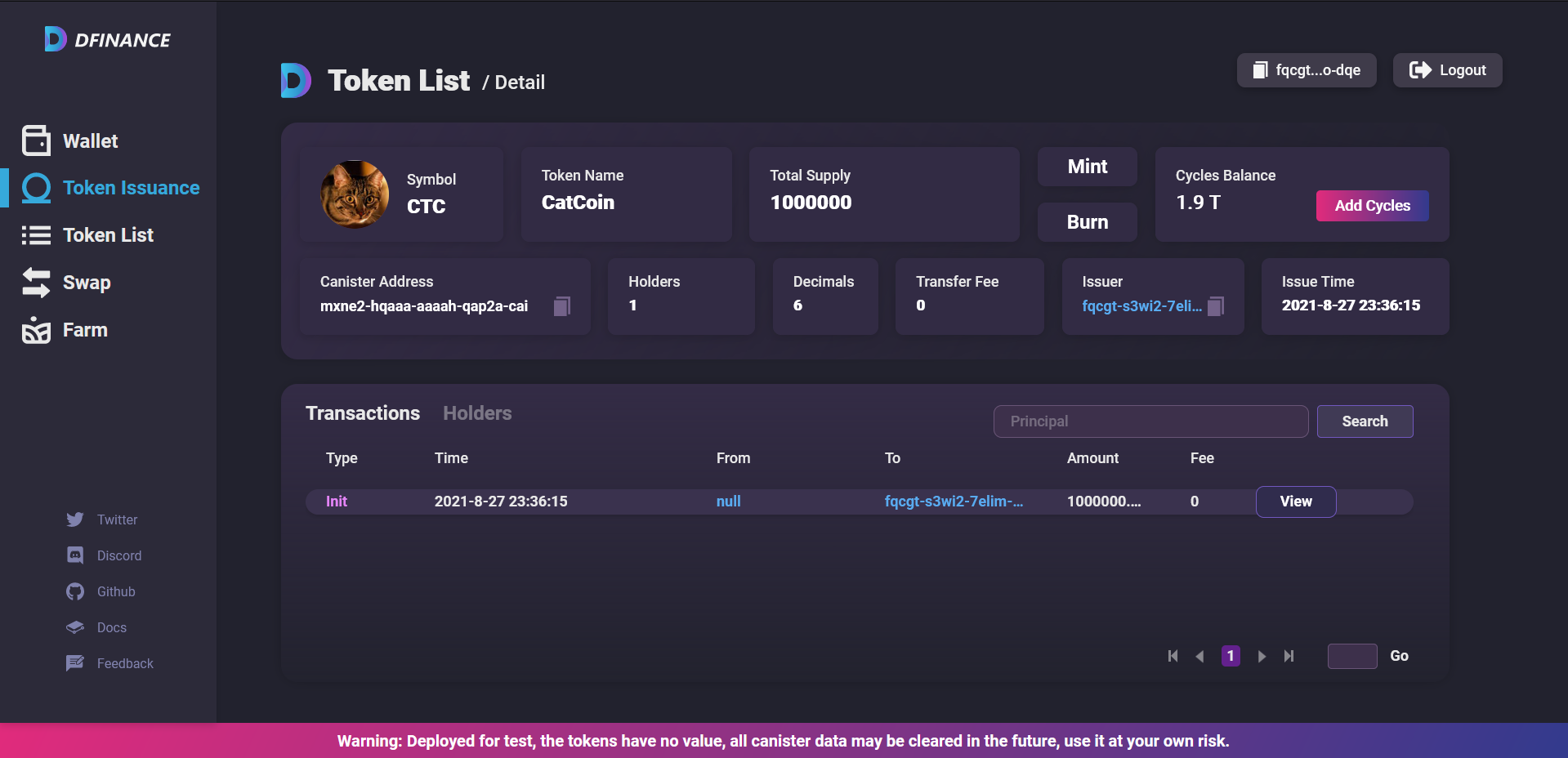

One-Click Token Issuance

DFinance allows for one-click token issuance. It has implemented a fungible token standard similar to ERC20 for Internet Computer.

During the testnet phase, users are charged 10 DFC as an issuance fee.

Token minting is limited to 1 per user. This is because the deployment of a token canister costs 2 trillion cycles ( approx $2.8 ). These restrictions will be removed after the mainnet launch.

We can see that Mintable and Burnable option has been selected for the token while creating it. This enables the token issuers to mint or burn tokens later when it is required.

More tokens can be found on the Token List menu.

DFinance Swap

DFinance brings lightning-fast swap without sacrificing decentralization, which is only possible on the Internet Computer.

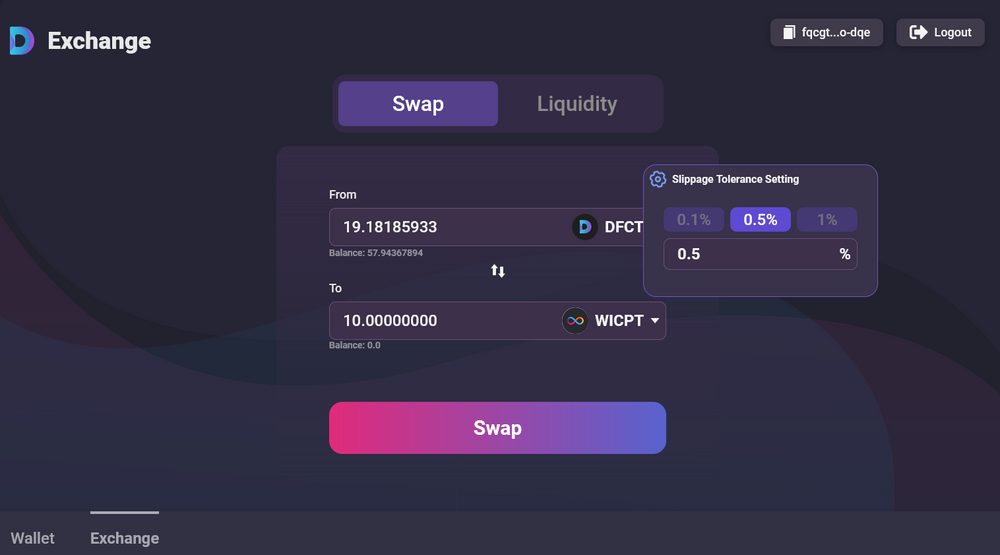

To avoid inner canister call delays and generate atomicity, DFinance employs a tight coupling architecture design for DSwap, and the AMM functions are implemented in a single canister.

Swap happens in a single canister which allows the DEX to achieve atomicity.

All of the processes of DFinance happen on-chain; this demonstrates the power of Smart Contract Canisters.

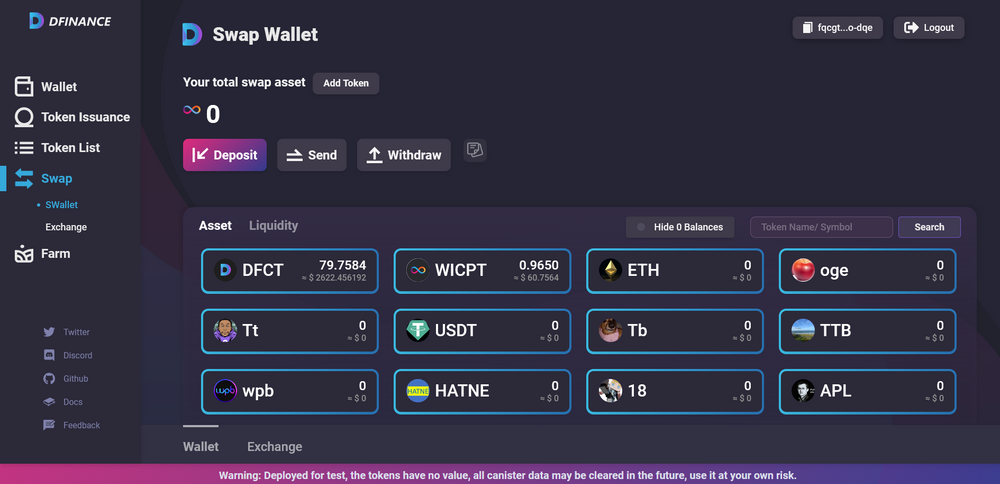

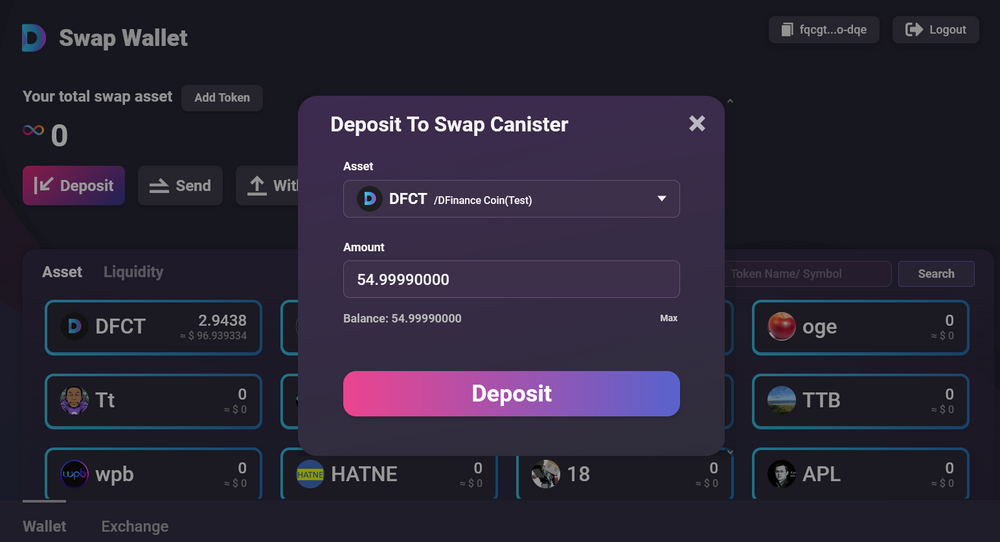

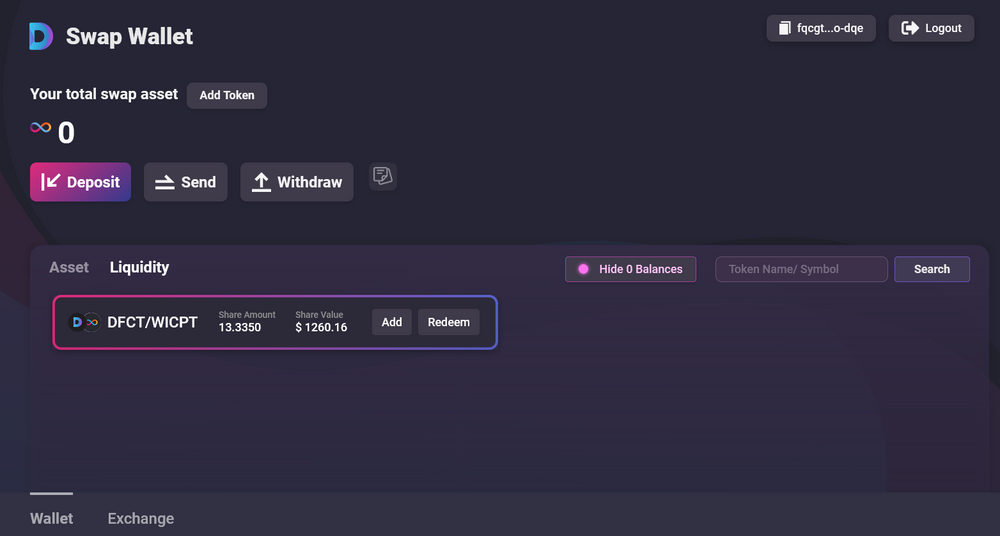

Users must deposit tokens to DSwap - Swap wallet if they want to swap or provide liquidity. Users can withdraw the tokens whenever they want from the DSwap wallet to the DFinance wallet. The Send function allows the internal transfer of assets to other addresses within the DSwap canister.

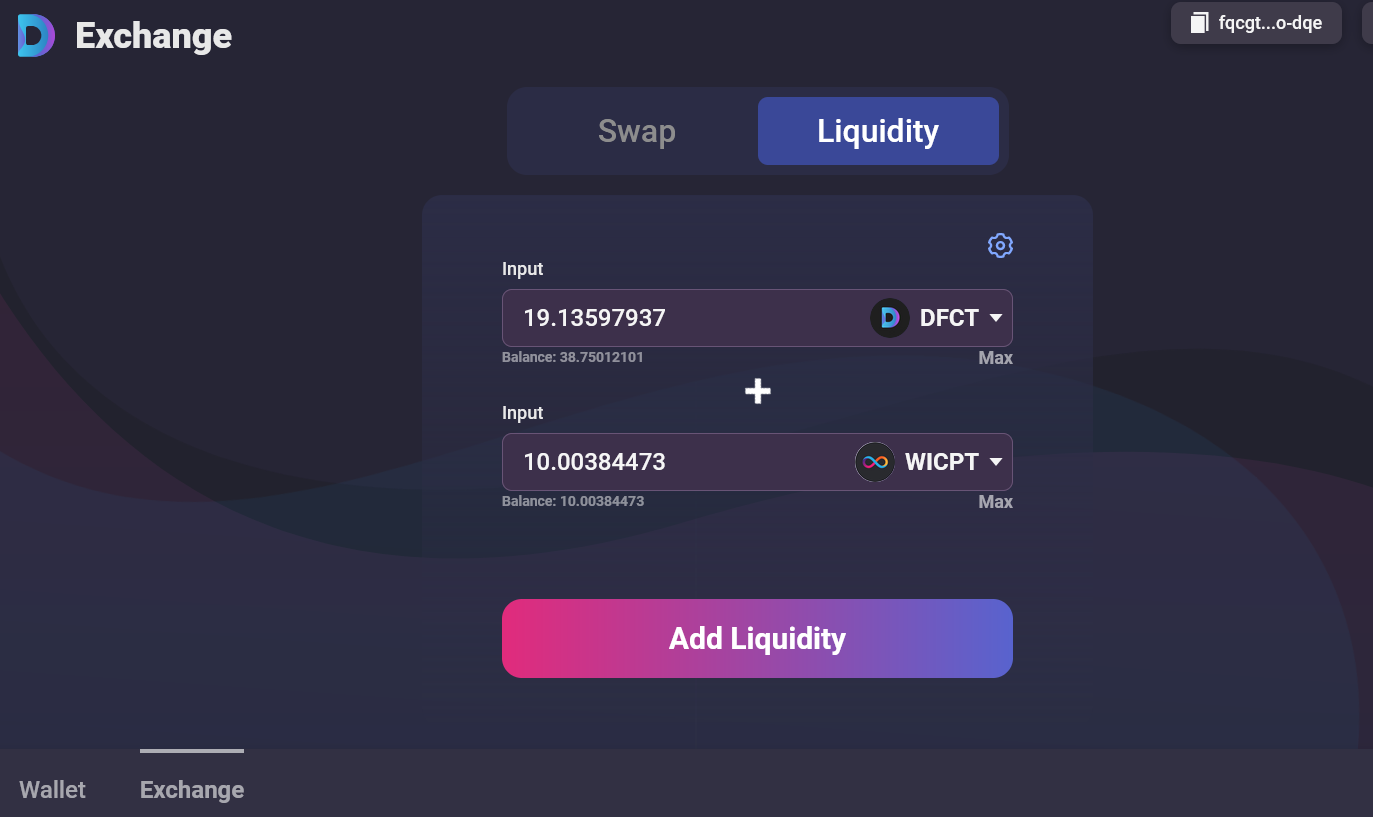

Users can also provide liquidity to the pair of their choice.

To provide liquidity, users must first have the tokens in their DSwap wallet. Right now, the only pair functional and eligible for liquidity farming is DFCT/WICPT pair. The first step is to deposit the DFCT token to the DSwap wallet and swap it for WICPT using the swap.

Then go to the Exchange menu, select the token pair to swap, set the slippage tolerance, and then Swap it.

Slippage tolerance shouldn't be a problem as Internet Computer operates at Web-Speed.

After Swapping, you can withdraw the swapped asset or provide liquidity using the swapped address. Go to the liquidity menu and select the pair.

You can redeem the tokens from liquidity pair whenever you want to:

The liquidity provided to Liquidity Pools can be used to farm DFCT tokens.

Liquidity Farming

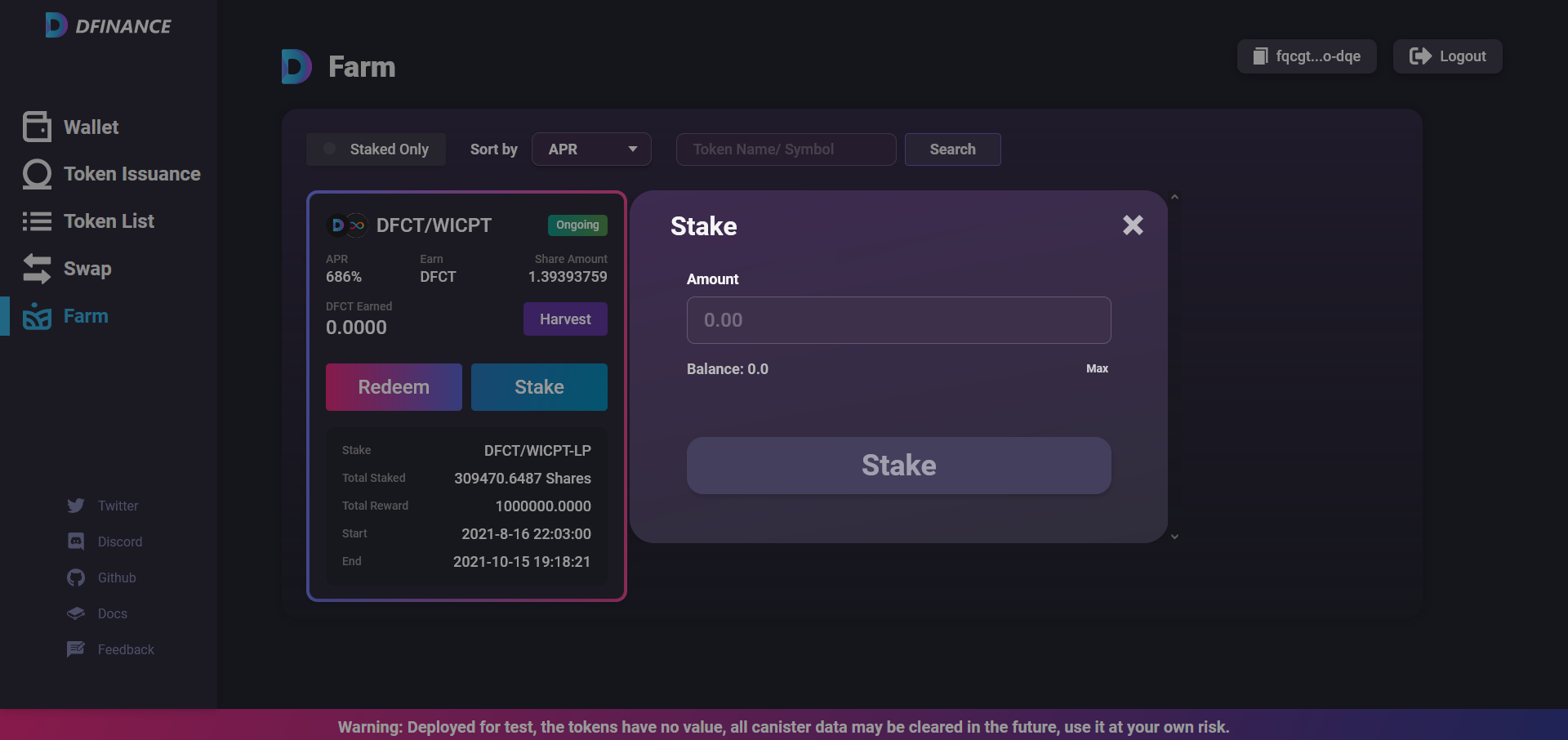

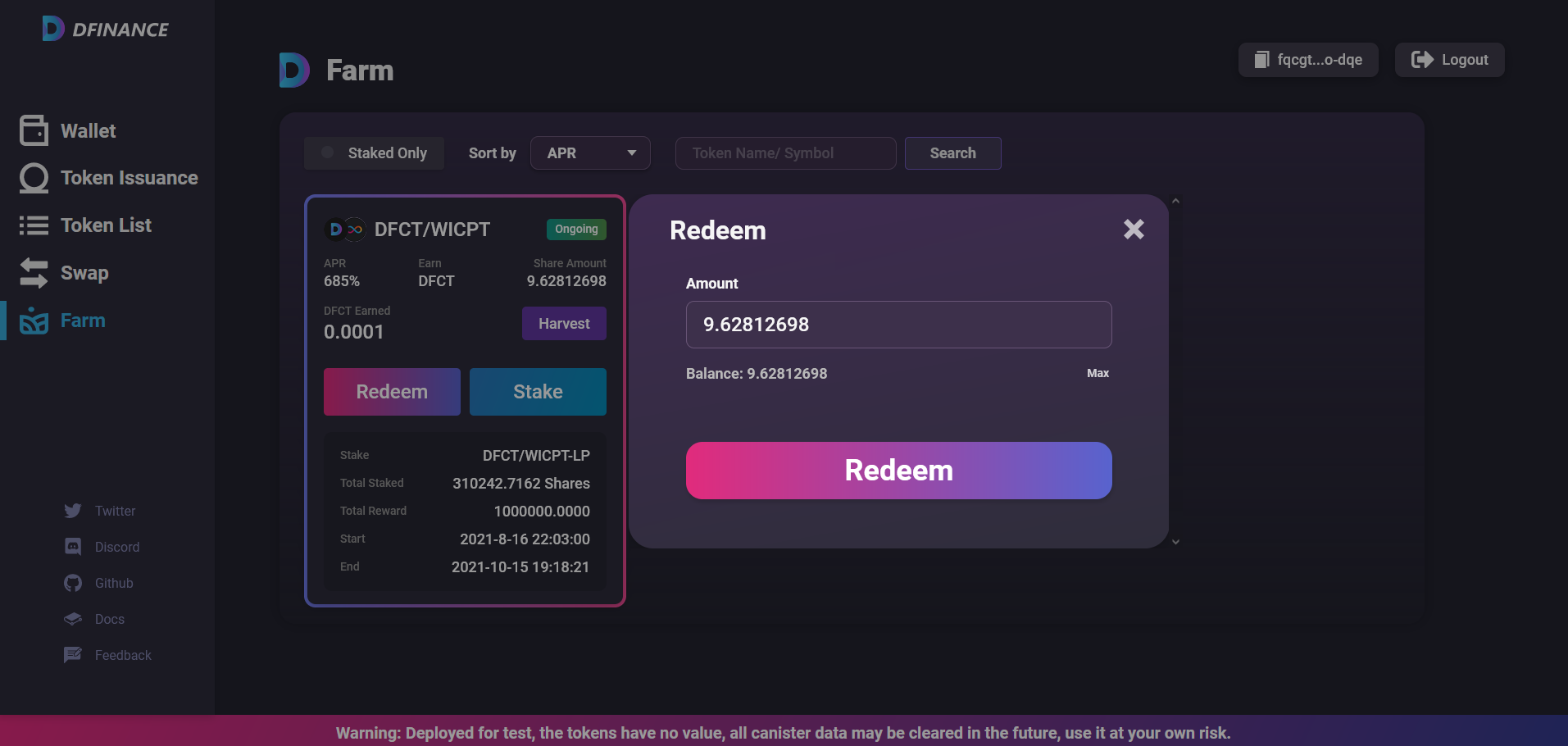

Users can provide liquidity to specific pairs of tokens and use the Liquidity Provider (LP) tokens to stake and earn rewards from the farm pools.

Staking allows the farm canister to use the LP tokens and provide rewards. These rewards can be harvested by clicking on the Harvest button. The LP tokens can be withdrawn by pressing the Redeem button.

Users can see that no gas fees are charged for any of the processes!

RoadMap by the Team

DFinance released this roadmap on their OnePager. What’s interesting here is DUSD; this might be a CDP model stable coin pegged to USD, backed by underlying assets like ICP.

Tokenomics will be discussed in the future, and there is a 0.3% transaction fee for every swap, which will be distributed to Liquidity Providers.

User Experience from testnet and Recommendations

User experience

- The swap was swift and smooth.

- One-Click token issuance is as easy as it sounds.

- Mintable and Burnable option to the issued token is a good feature and is necessary.

- Liquidity Farming was easy to execute.

- I did not have to pay any gas fees at all for interacting with the DEX.

One-Click login using Internet Identity is a fantastic feeling. If anyone prefers seed phrases, they can create a browser wallet. However, an Identity management service is required as canisters are interoperable in nature. The Community governance decides what is best for the Open Internet Service.

Recommendations

NFT functions and other NFT related features must be explored. Charts and other metrics are required to track the Price movement on the DEX itself.

Thorough documentation and video tutorials are needed. Small instructions can be displayed on swap interfaces. This will helps folks who are familiar with crypto to use the DeFi, thereby making DeFi available to everyone.

Bug bounties and community incentives, interoperability between native exchanges should be explored.

Just like any other IC dapp, DFinance provides an incredibly smooth experience in testnet! This makes me excited for the future of DeFi as we are going to witness a revolution.

Connect with DFINANCE

Twitter | Telegram | Discord | Github | Medium | DSCVR | Website | Documentation

- Disclaimer: The views and opinions expressed on this website are solely those of the original author and other contributors. These views and opinions do not necessarily represent those of the Dfinity Community staff and/or any/all contributors to this site.

Comments are for members only. Join the conversation by subscribing 👇.